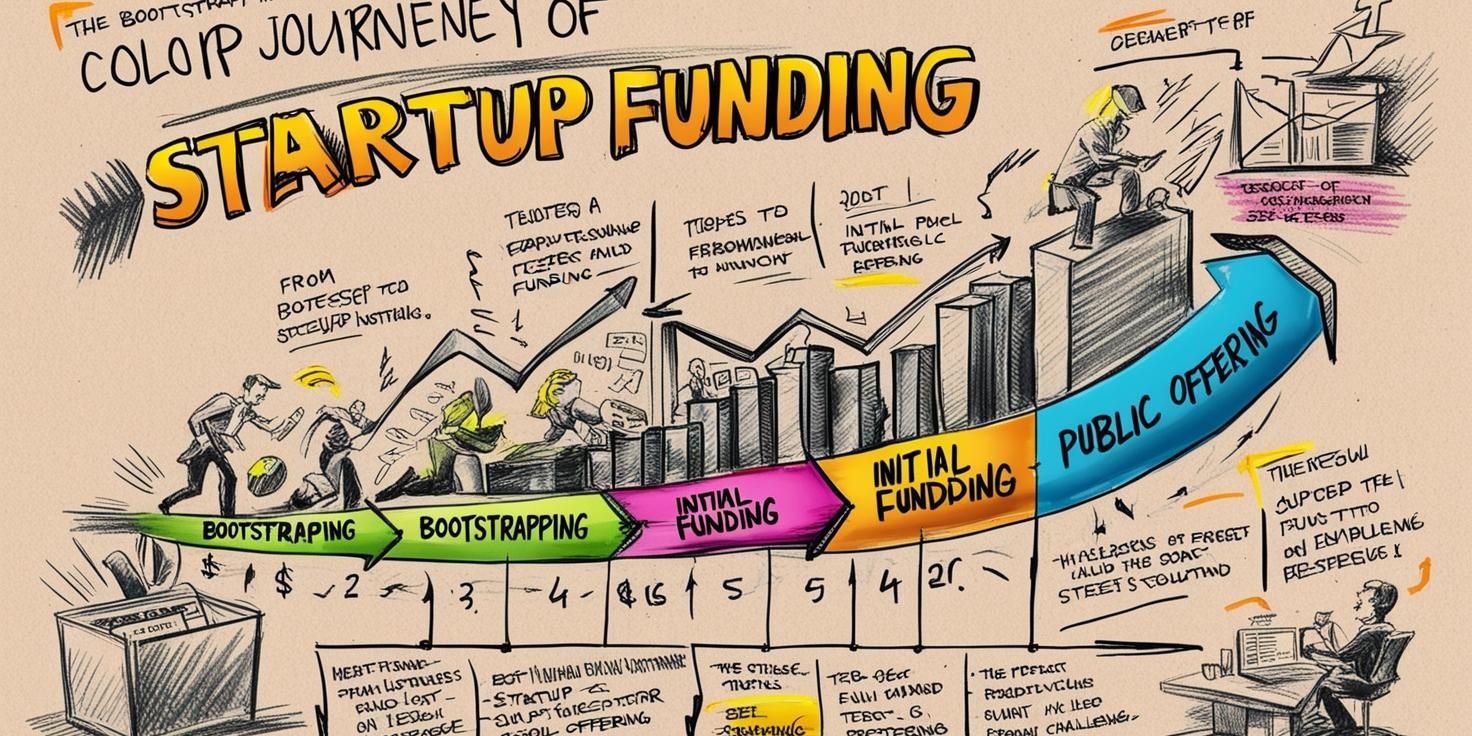

Startup Funding Stages Explained: From Bootstrapping to IPO 🚀

Master

The Various Funding Stages of a Startup: A Comprehensive Guide

Every successful startup goes through distinct funding stages as it grows. These stages allow startups to secure the capital they need to move from an idea to a scalable business. Each funding stage aligns with specific milestones, risks, and growth objectives, and understanding these stages is critical for both founders and investors.

Let’s explore the key funding stages of a startup, from the earliest phases to large-scale funding rounds, with examples to illustrate each.

1. Bootstrapping (Self-Funding)

What It Is:

This is the initial stage where founders use their own savings, revenue, or resources to fund their startup. It’s often used to build a prototype or test the idea before seeking external funding.

Key Characteristics:

• Minimal outside help.

• Heavy reliance on personal finances or revenue from early customers.

Example:

Mailchimp, a leading email marketing platform, was entirely bootstrapped for nearly two decades. The founders used revenue from early customers to scale the company organically.

2. Pre-Seed Funding

What It Is:

This is the earliest stage of external funding, often referred to as the “friends and family round.” Startups raise a small amount of capital to develop their product idea or build an MVP (Minimum Viable Product).

Key Characteristics:

• Funding Source: Friends, family, angel investors, or startup competitions.

• Funding Size: Typically <$500,000.

• Focus: Validating the business idea and creating an MVP.

Example:

Robinhood, the stock-trading platform, initially raised pre-seed capital from friends and family to build its first product prototype.

3. Seed Funding

What It Is:

The first formal round of funding, often led by angel investors or early-stage venture capital (VC) firms. Startups use this capital to finalize their MVP, conduct market research, and secure their first customers.

Key Characteristics:

• Funding Source: Angel investors, early-stage VC firms, or crowdfunding platforms.

• Funding Size: $500,000 to $2 million.

• Focus: Achieving product-market fit and launching in the market.

Example:

Airbnb raised $600,000 in seed funding in 2009 from investors like Sequoia Capital to refine its platform and expand its initial customer base.

4. Series A Funding

What It Is:

Series A is the first significant VC round. It’s aimed at startups that have proven product-market fit and need capital to optimize their business model, grow their team, and expand their reach.

Key Characteristics:

• Funding Source: Venture capital firms.

• Funding Size: $2 million to $15 million.

• Focus: Scaling operations, optimizing the product, and growing the user base.

Example:

Instagram raised $7 million in Series A funding from Benchmark Capital in 2011 to expand its engineering team and improve app functionality.

5. Series B Funding

What It Is:

This stage is for startups that are gaining significant traction and require capital to expand operations, enter new markets, or scale their product further.

Key Characteristics:

• Funding Source: Larger VC firms, growth equity firms.

• Funding Size: $15 million to $50 million.

• Focus: Market expansion, team growth, and improving scalability.

Example:

Dropbox raised $25 million in Series B funding in 2008 from Sequoia Capital to enhance its infrastructure and grow its customer base.

6. Series C (and Beyond) Funding

What It Is:

This stage is for mature startups that need funding for large-scale expansion, acquisitions, or preparing for an Initial Public Offering (IPO). Startups in Series C (or D, E, etc.) are often less risky, as they have proven business models and steady revenue streams.

Key Characteristics:

• Funding Source: Late-stage VCs, private equity firms, hedge funds, and investment banks.

• Funding Size: $50 million or more.

• Focus: Global expansion, acquisitions, or market dominance.

Example:

SpaceX raised $1 billion in Series C funding from Google and Fidelity in 2015 to support its ambitious projects, including satellite deployment and reusable rockets.

7. Initial Public Offering (IPO) or Exit

What It Is:

At this stage, the startup transitions into a public company by offering shares to the public. Alternatively, some startups may choose an acquisition or merger as their exit strategy.

Key Characteristics:

• Funding Source: Public markets (for IPO) or acquiring companies.

• Focus: Generating liquidity for investors and founders.

• Mark of maturity for the startup.

Example:

Uber went public in 2019 with a valuation of $82 billion, raising $8.1 billion through its IPO.

Comparison of Funding Stages

Stage Source Amount Raised Focus

Bootstrapping Founder’s savings <$50,000 Idea validation, early expensesPre-Seed Friends, family, angels <$500,000 MVP creation, market researchSeed Funding Angels, early-stage VCs $500K–$2M Product-market fit, market entrySeries A VC firms $2M–$15M Scaling operations, user growthSeries B Growth-stage VCs $15M–$50M Market expansion, team scalingSeries C+ Private equity, VCs $50M+ Global expansion, acquisitionsIPO/Exit Public markets Varies Liquidity for investors, dominance

Conclusion

Understanding the funding stages of a startup is crucial for entrepreneurs looking to scale their business and for investors aiming to maximize returns. Each stage serves a specific purpose, from validating the idea to scaling globally or going public. By tailoring your funding strategy to your growth stage and leveraging the right resources, your startup can successfully navigate the journey from inception to maturity.